Pega Sales Automation for Financial Services

"We are transforming the way our sales staff interact with clients using mobile devices, real-time decisioning, and robust 360 views of the client holdings and previous interactions."

Get to know Pega Sales Automation for Financial Services

Improve relationship banking

Align suitable products and services with customers’ needs using AI-driven predictive analytics. Pega’s system empowers agents with top offers that drive revenues, as well as the insights they need to provide customer-focused responses and financial advice.

Guide selling with

personalized sales processes

personalized sales processes

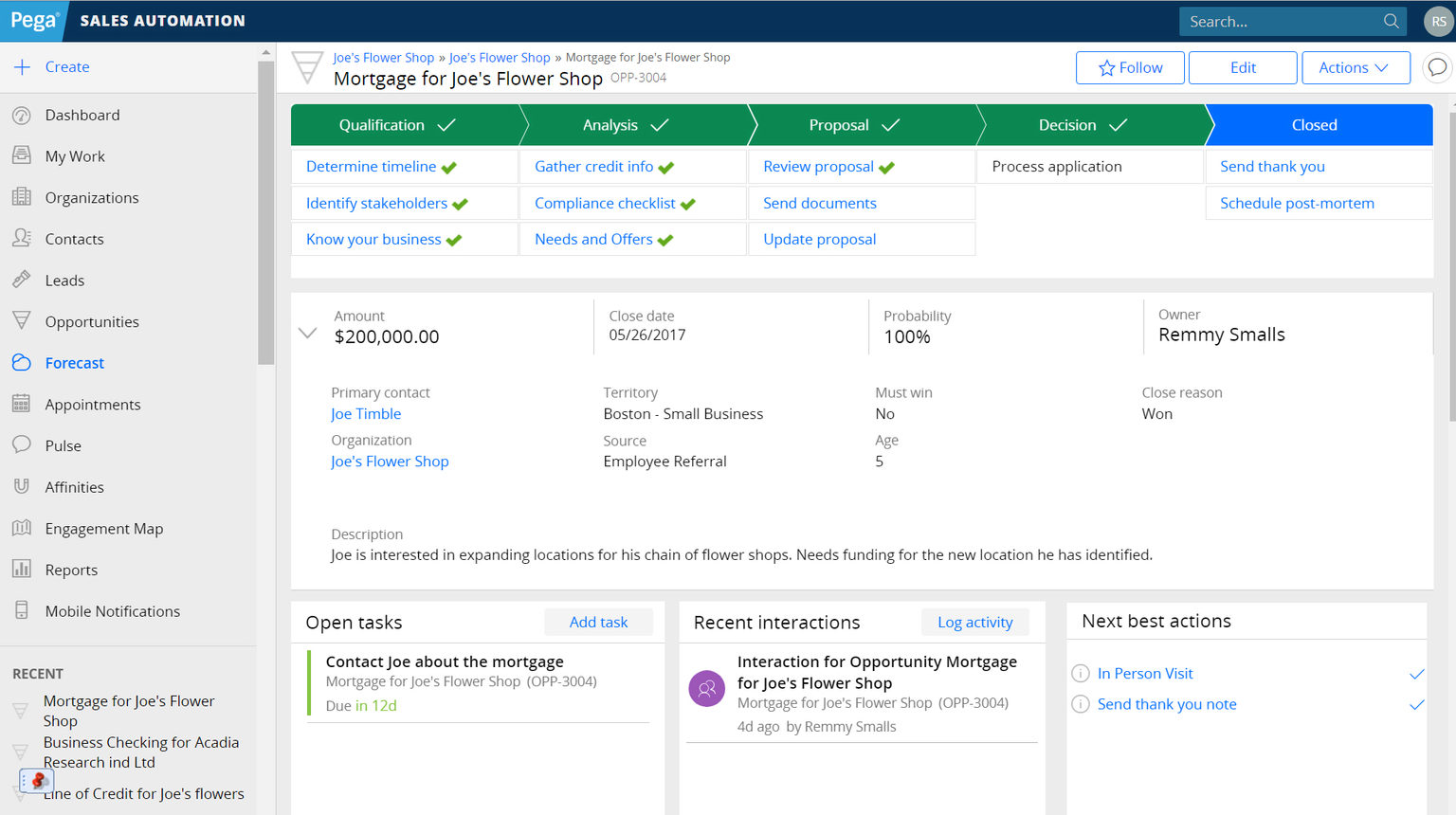

Ensure all agents and trusted advisors maximize their capabilities with automated, intelligently guided next best actions. Our system blends predictive analytics, knowledge management, and customizable process flows to quickly change sales methodologies to align with priorities and meet compliance needs.

Eliminate silos with

a unified CRM suite

a unified CRM suite

Present “one bank” to the customer by connecting marketing, sales, onboarding, and customer service through their entire journey. When a customer’s accounts, transactions, and banking activities are all in one place, everyone can focus on what matters: customer trust.

Engage anytime with

mobile enabled banking

mobile enabled banking

Collaborate with clients in a branch or on-site using the Banker’s Tablet™. Use our iOS or Android application for mobile access to scheduling, notes, and opportunity details.

Satisfy regulators with

fully compliant audit trails

fully compliant audit trails

Whether coaching sales staff or filling customers’ product, account, or service needs, banks need to ensure every move satisfies regulators. Through guided processes and a full audit trail, Pega’s system helps banks with all their compliance needs.

Additional Product Features

Territory Management

Create multiple territory models and associated permissions for direct and channel sales teams.

Account and Contact Management

Have a complete view of customer/agent activity history, communications, and internal discussions.

Lead and Opportunity Management

Track leads and opportunities from creation to close, and manage sale stage requirements.

Tasks and Activity Management

Automatically trigger reminders, tasks, and activities for approvals, onboarding steps, and more.

Sales Content Management

Share files, discuss them, and push content in real time based on sales situation.

Omni-Channel Management

Tap into client/prospect on- and off-line activities with Pega Marketing and Pega Customer Service.

Related Resources

Analyst Reports

The tides of customer relationships for financial services are turning. Customers expect more from the banks and firms where they do business. Pega can help.

Customer Case Studies

See how customers are using Pega Sales Automation for Financial Services to transform their enterprises.

Case study

Learn how Pega was able to help Alfa Bank to improve sales effectiveness, increase cross-sell revenue, and decrease attrition.