Pega Customer Service for Retail Banking

Improve the customer experience in each and every interaction.

"We set out to create an integrated solution that meets the needs of customers and exceeds their expectations."

Get to know Pega Customer Service for Retail Banking

Guided interactions

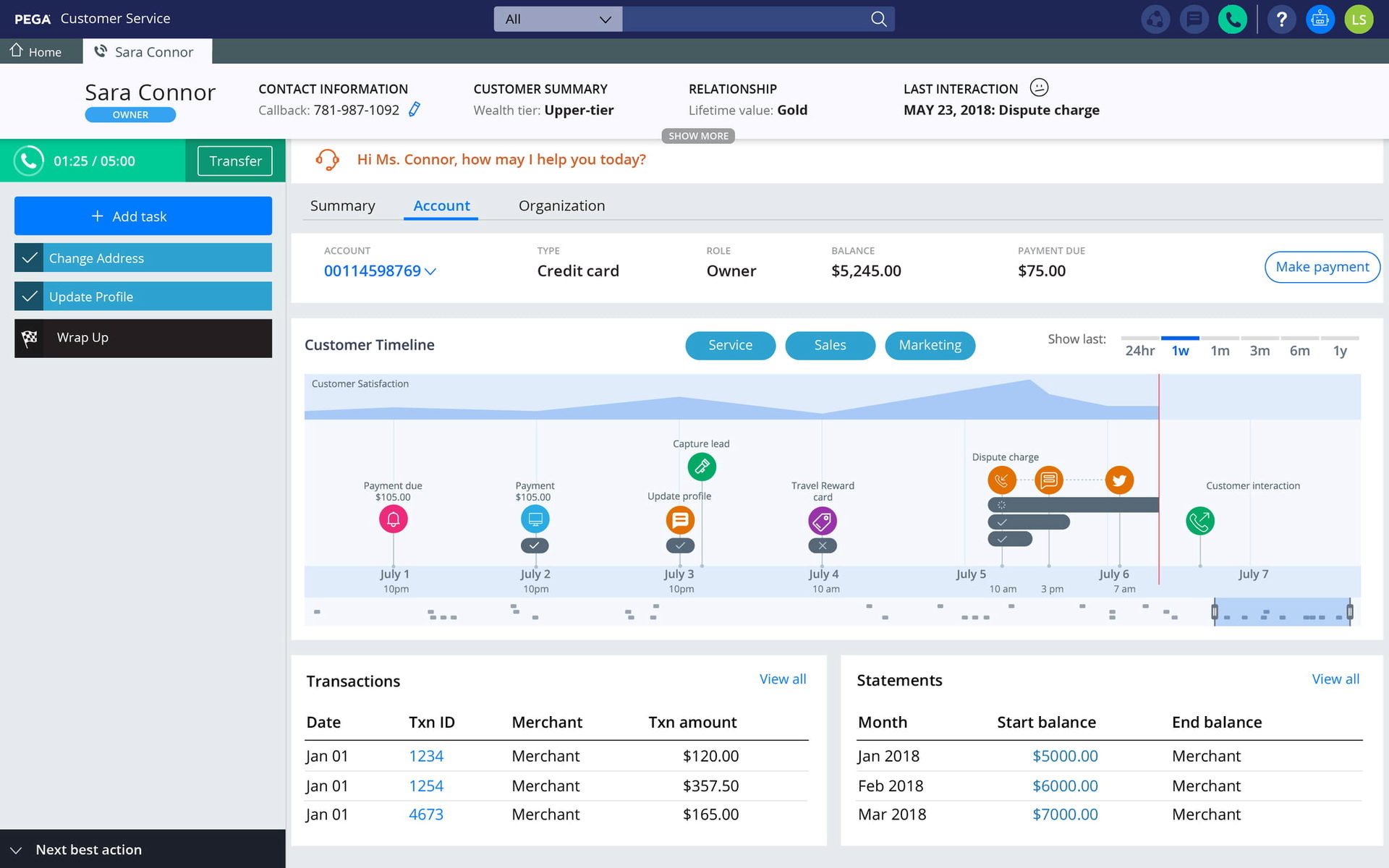

Provide a better customer experience by adapting your service to each customer’s needs based on the situation. Pega intelligently guides users step by step or suggests the next best action to help you deliver more personalized service, reduce the need for training, and ensure compliance.

Omni-channel experience

Give your banking customers a consistent experience via any channel. With Pega, customer interactions transition seamlessly across devices without losing the context of the conversation. Meanwhile, your CSRs have visibility into customer history regardless of the channel.

Case management

To keep your promises to customers you need to connect the people, systems, and enterprise processes required to resolve inquiries. Pega links front- and back-office activities with automated work assignments and prioritization to deliver end-to-end resolution in accordance with bank policies.

Customer service desktop

Deliver a high quality customer experience while simultaneously improving productivity, with clear visibility into the entire customer relationship. Pega’s contact center interface is beautiful to work with, yet powerful enough to support the complexities of the world’s largest banks.

Web and mobile mashup

Customer interactions need to move seamlessly across channels to deliver a consistent experience. Embedding Pega directly into your existing channels with Pega Mashup brings dynamic case and process management directly to customer touchpoints, instead of hard-coding each channel independently.

Additional Product Features

Two or more parties can securely share the same web page with just a single click.

Pega Live Data

Retrieve customer data from existing systems in real time while preserving data integrity.

Pega Cloud

Manage, change, and deploy your applications from virtually anywhere.

CSRs can listen to social conversations, analyze customer sentiment, and give appropriate responses.

Provide an efficient, consistent customer service experience for website visitors.

Pega recommends relevant, timely information based on the current customer interaction.