Pega Credit Risk Decisioning

“We want to help people prepare for the future. So more digital, straight-through processes and better customer experience. That’s where Pega comes in and Pega stands out."

Modernized and impactful

credit risk decisioning

credit risk decisioning

Infuse the credit risk process with real-time decisioning for a connected and relevant customer experience and faster time to value. Operationalize risk models for increased efficiency and accurate assessments and infuse transparency into your strategy to improve control and outcomes.

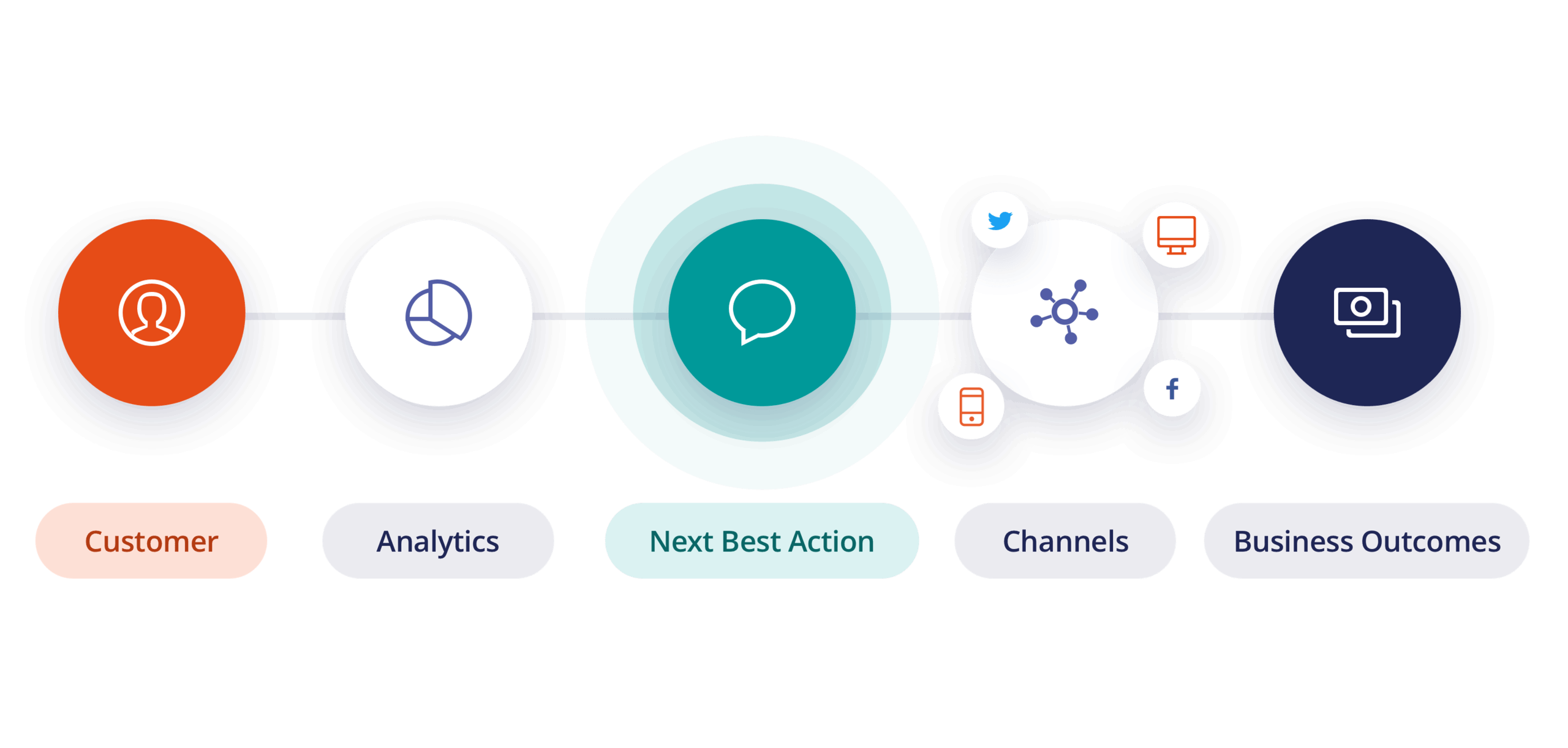

Delight customers with

omni-channel consistency

omni-channel consistency

Pega puts the customer at the center of their journey. Achieve channel independence with Pega, ensuring that customers and employees have a unified and contextual experience across all their channels that is aligned with their goals.

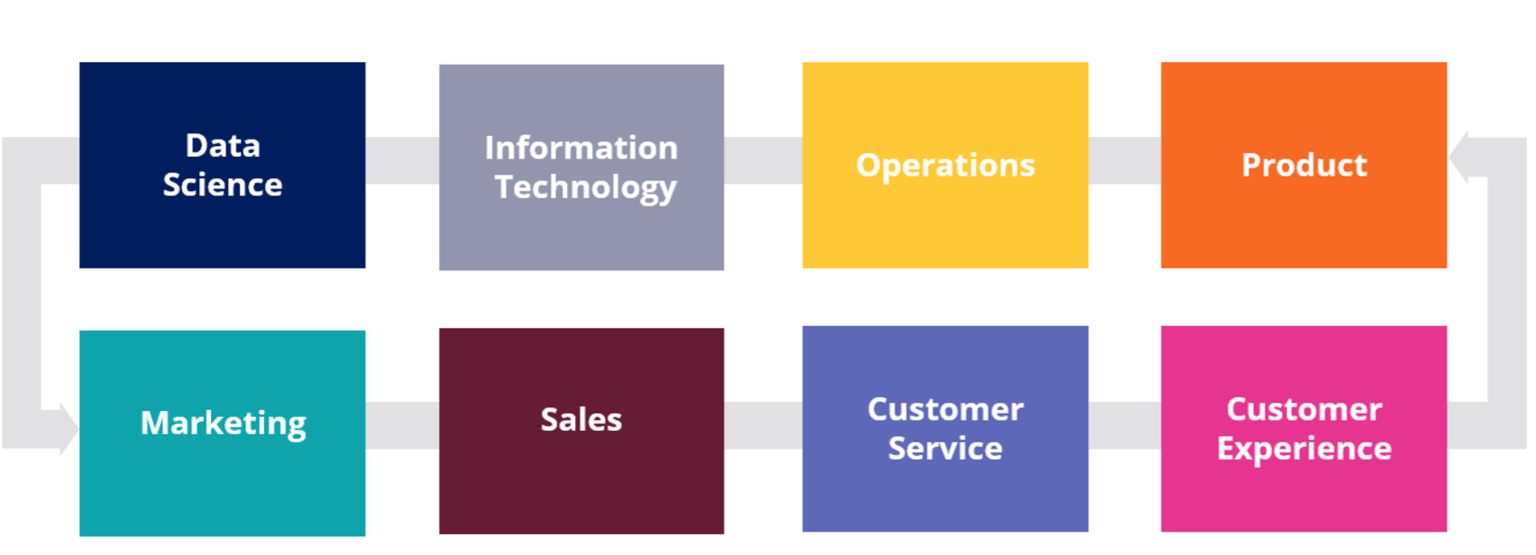

Integrate brilliantly with

whole-business collaboration

whole-business collaboration

Supercharge your organization by connecting your risk management functions with marketing, sales, service, and beyond. Pega enables you to break down silos and establish a front office approach to risk.

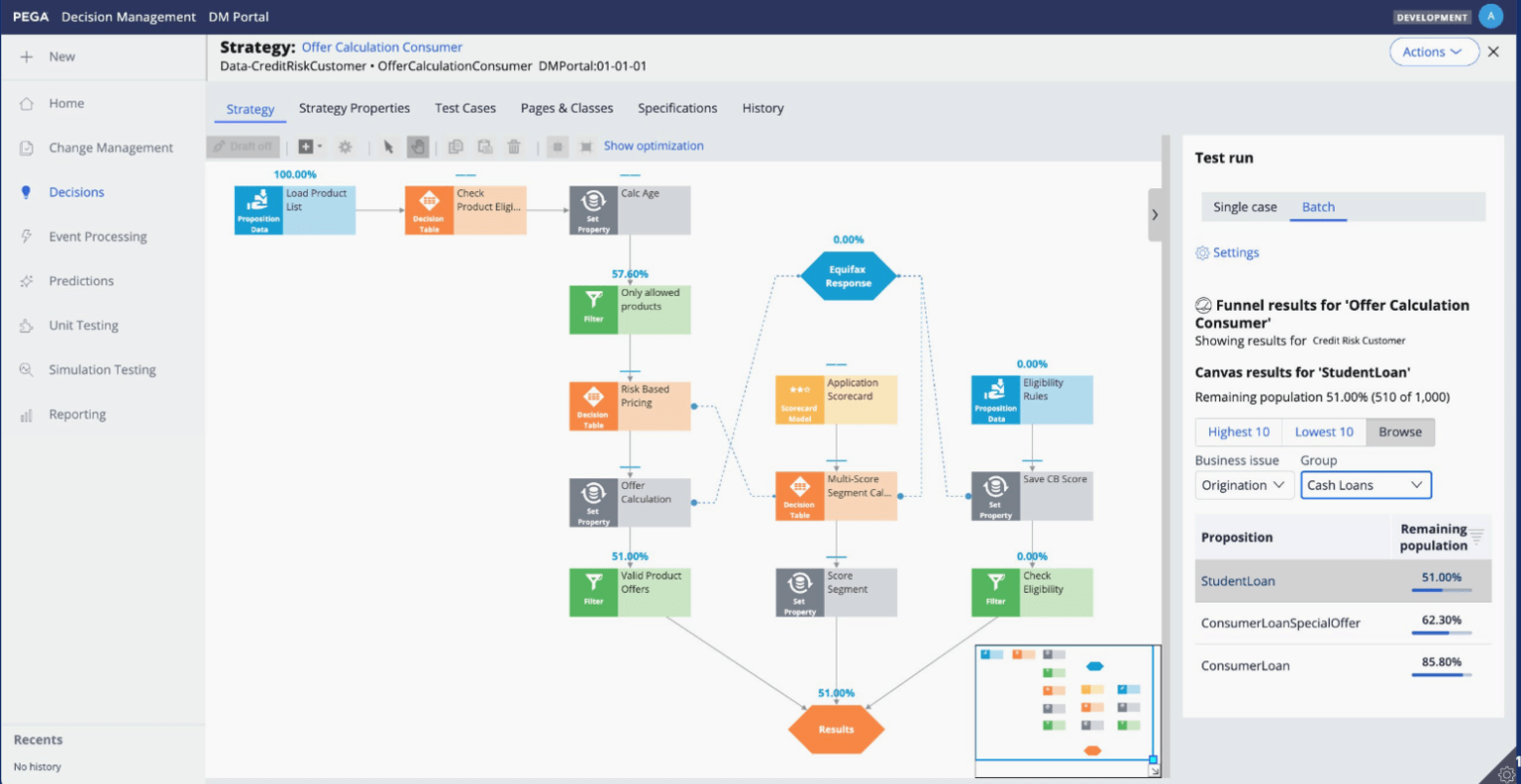

Make better decisions with

the Customer Decision Hub

the Customer Decision Hub

Blend risk management with your offers, marketing, sales, service, and pricing to win over customers with increasing expectations. The Pega Customer Decision Hub acts as a centralized brain, powered by artificial intelligence and real-time data.

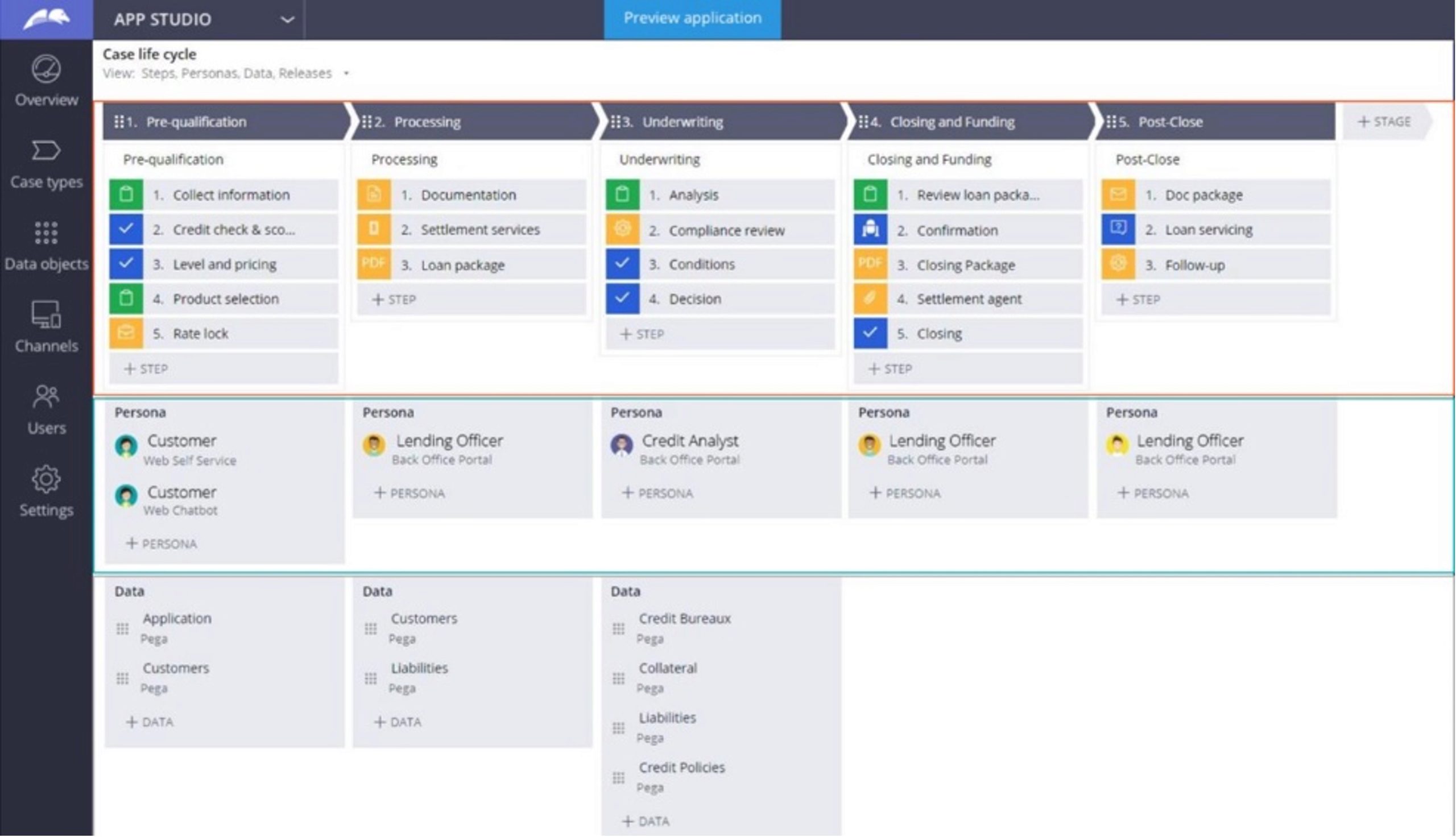

Streamline workflows with

dynamic case management

dynamic case management

Anticipate change, enhance service levels, and free up time for your relationship managers and risk officers by connecting your processes, workflows, and existing systems. Audit trail information, versioning, and governance are all managed by the Pega platform.