Customer data platforms (CDPs), data-driven projects, big data, analytics centers of excellence, digital transformation – popular concepts these days. And along with these concepts, new roles have appeared, like the Chief Data Officer (CDO) and Chief Analytics Officer (CAO). Just 10 years ago, few firms had these positions. By 2018, however, a New Vantage Partners’ survey found nearly 65% of Fortune 1000 firms had a CDO. But concepts and roles alone won’t solve any problems without the right underlying data and analytics strategy.

Despite data galore, consumers still crave better customer experience (CX). Nearly every new CX study has a statistic like, "9 out of 10 customers are underwhelmed by the CX they receive." In the face of this exciting and herculean problem to solve, we eagerly rally support and invest in studies and technologies in the hopes of finding a permanent customer data solution.

Perhaps it’s time to pause and ask if the right customer data strategy is in place to guide these efforts.

I’ve seen enterprises struggle with this for 30+ years. Why is that? I think it’s because of data FOMO (fear of missing out) if you don’t collect data first – and ask questions later. As a result, the strategy merely becomes one of data collection, protection, storage, and general distribution. That approach doesn’t answer the basic questions such as:

- Why is the data collected in the first place?

- Is collecting it in the best interests of all parties?

- How will it add value?

As a result of this backward approach, data platforms – like the CDP category – masquerade as wholesale solutions but supply no evidence of wide-scale effectiveness. That’s why it’s crucial for the Chief Data Officer to systemically invest in data-design thinking. And in doing so, communicate and foster a well-articulated corporate data and analytics strategy.

So, what is data-design thinking?

Simply put, it refers to the cognitive, strategic and practical processes by which data blueprints (proposals for new using data) are developed. Essentially with it, the Chief Data Officer tasks everyone with data rigor. For instance, he or she would call for every project to apply a litmus test to check whether proposed data use (i.e., data designs) have a specific value-oriented purpose – one the designers can measure. That puts the burden on the designers to consider trends such as consumer tracking and data privacy , and the power of those outside forces to disrupt and even vaporize projected benefits.

Take for example the recent news that Google plans to eliminate third-party cookies on Chrome in a couple of years. This one announcement alone has far-reaching implications for any firm involved with collecting and using third-party cookie data – which is nearly everyone.

With all that in mind, here are five principles grounded in answering fundamental questions such as what data to collect and why. And once collected, how the Chief Data Officer should oversee the encoding, protecting, storing, curating, and distribution of it.

Data-Driven Insight #1: Quality not quantity

It’s crucial to collect data predicted to be instrumental in providing beneficial services. Seek clean data sources and don’t stockpile data. Being data-driven doesn’t mean being a garbage collector and data hoarder – data is a liability when it’s dirty and not used (“garbage in – garbage out”). It costs money to gather and store and its value diminishes quickly with time. It’s easier than ever to add it later should you run an experiment telegraphing its worth, so rather than amassing data for no reason, activate it once there’s a use. Then, just feed on the most recent renditions instead of backloading historical values from months or years ago, which possess limited decision-making power. The key is to source the right data types that can impact how you deliver CX today.

What are those data source types? Before answering that, let’s first understand the broad groups of data:

|

Data source type |

Description |

|

First-party data |

Data collected directly from a customer |

|

Second-party data |

First-party data obtained (usually bought) from the original collector |

|

Third-party data |

Data obtained (usually bought) from an aggregator |

Data types underpin digital systems. Sourcing and squeezing the right data can have a huge bearing on how well digital systems function.

With that in mind, my advice is to keep the focus on first-party data since it tells the direct story of customers’ actions and intentions. And you directly control its accuracy and recency. Specifically, concentrate on these first-party data collections:

Behavior data – “What I’ve done”

|

First-party data |

Example |

|

Product holdings and use |

Products owned, accessories bought, subscriptions; contract details; product/services consumed |

|

Purchase summaries |

Recent purchases, frequency of purchases, the monetary value of purchases (known as RFM) |

|

Loyalty summaries |

Points and status history, redemption history, current balance |

|

Interaction summaries |

Promotional impressions, offer responses, service case dispositions |

|

Channel behaviors |

The last page visited, time spent on a page, mobile app behavior |

Profile data – “Who I am”

|

First-party data |

Examples |

|

Descriptive elements |

Age, gender, ethnicity, marital status, zip code (beware, as some of these attributes can lead to biased decisions) |

|

Stated preferences |

King bed, high floor, electronic statements |

|

Connections |

Spouse, children, LinkedIn connections, Twitter followers, group affiliations |

Contextual data – “What’s happening now”

|

First-party data |

Examples |

|

Location |

Current geo-location (proximity to a store, airport, etc.) |

|

Environmental conditions |

Local weather, traffic conditions, disaster area status |

|

Mood/Emotional condition |

Sentiment trend, current emotional state |

|

Intent |

Near-term goal, current agenda/motivation |

The following data derived from statistical models could be self-generated (first-party) or purchased (third-party). In either case, model accuracy and refresh rates are important considerations.

Modeled data – “Predictions”

|

First- or Third-party data |

Examples |

|

Credit risk |

FICO score, the likelihood of default |

|

Satisfaction |

NPS score, churn score |

|

Wealth assessment |

Investable assets, disposable income |

|

Value assessment |

CLV (customer lifetime value), the share of wallet |

Resembling a scattering of clues in a mystery, each data feature alone describes but one aspect of a customer, yet used together they can build a narrative, supply insight, and lead to better decision making. Also, remember any data collected has a shelf-life. Keep this in mind and use the time to live on data elements as a way of managing how long selected data survives.

Data-Driven Insight #2: Safeguard customer data like a banker with money

When you entrust your hard-earned money with someone, first and foremost you expect them to safeguard it. But in addition, you lend it because you trust they’ll do something positive with it. They get capital to power their business; you get a negotiated cut.

Data is no different. Above all, when you lend it (notice I didn’t say “give it”) you expect security. Yet you also want fair terms and conditions associated with privacy and its use. But today, most businesses don’t think of data this way. Instead, they act as if they’re entitled to because they found it and feel empowered to exploit it as they see fit.

If you practice data-design thinking, however, you’ll be changing this mindset. With specific reasons for collecting and refining customer data built into the fabric of your system building methodology, you can be up-front with customers about the terms of use such as:

- Why data is being collected

- How you plan to use it to produce mutually beneficial value

- How long it will be kept

By law, firms must disclose “Privacy Policies” but I’ve never read anything in those 60+ pages of fine print that answer any of these questions. That brings us to the next principle – fair and responsible use.

Data-Driven Insight #3: Use data responsibly

There’s lots of chatter these days about responsible, ethical, and empathetic AI. And when you peel back these terms, data is at the core. Without data, machines can’t learn. With it, as food to a body, AI becomes what it eats. Hence, the importance placed on data strategy and principles will have a huge bearing on how well your AI behaves.

Which leads us back to the data you choose to cultivate and let your AI consume.

The vast majority do the bare minimum to not break the law while looking for loopholes. For instance, in the U.S. (unless you live in California or Vermont) credit card companies can share your personal information for joint marketing with other financial companies, and you can’t limit it. But as a business claiming to be customer-centric, does that sound like terms of endearment?

And some organizations flat out break the law – writing any penalties off to a fail-fast strategy and as a cost of doing business. Earlier this year, Facebook reached a $550 million settlement with Illinois residents, based on a 2015 lawsuit alleging it used facial recognition without permission. Facebook, it’s my face, not yours!

In both cases, I’d argue for a mutual data agreement where it’s clear up-front why data is collected, how the firm intends to use it, and how that helps both parties. No doubt, data has the power to nourish, instruct, and add value, but it possesses equally destructive powers when not used dutifully. So, collect it responsibly, feed it to your AI carefully, and use it conscientiously.

Data-Driven Insight #4: Invest in Analytics Transformation

Again, like a banker, your chief fiduciary responsibility is to manage the spread on data (i.e., revenue minus cost). In other words, you must create more value from data assets than you spend on the resources to obtain and maintain them.

To do that effectively, you’ll need analytics excellence. And to get that you must embark on analytics transformation.

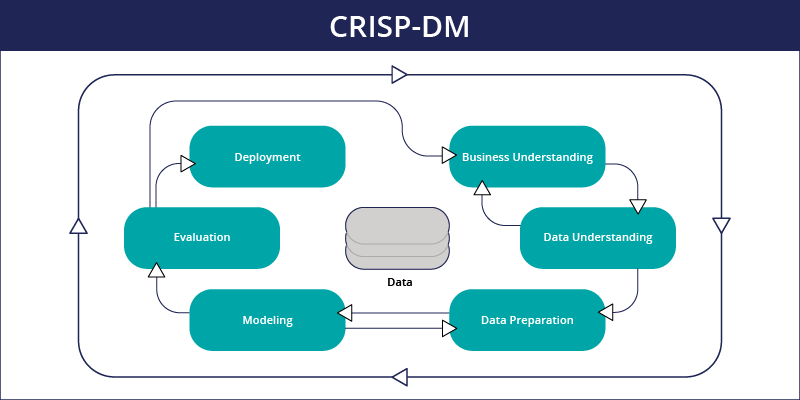

No different than digital transformation, in fact, an integral part of it, analytics transformation requires reorienting your data and analytics operating model around one simple concept – start with business understanding. As shown in in the diagram below, the data mining methodology starts with the business and data experts aligning and iterating on goals, production use, and measurement metrics.

Diagram: Cross-Industry Standard Process for Data Mining (CRISP-DM). Based on a graphic by Kenneth Jensen, Wikipedia .

Only once it’s clear the data and analytics can be deployed to drive positive outcomes should downstream work such as data preparation and modeling proceed.

This operating model calls for:

- Pegging data quality and data (life cycle) management efforts to value creation.

- Hiring data science talent with data, business, and analytics acumen. A technically competent statistician without collaboration, business, and domain skills is of limited value.

- A target to run 80% of data and analytics lights-out; with limited support from data science experts.

- Data science experts focusing their energy on innovation. Their job one: find new data, better signals, and deeper insights.

On the last point, analytics experts know that model performance eventually plateaus, and that new data will usually help more than refining existing data (Rule #41 – Google ML ). So, if they have automated monitoring and warning systems, they can spend more time experimenting with new data sources.

Data-Driven Insight #5: Be a data diplomat, not a troll

If the Chief Data Officer is to succeed, he or she must interlock with business line executives to create a common set of goals that align around a comprehensive data and analytics strategy - and then constantly iterate and collaborate.

In the beginning, data was rare, difficult to collect, and hard to access. A select few held the keys, stashed it away, guarded it like goblins, and required subpoenas to gain access. Advanced analytics was arcane science – reserved for Ph.D.s.

Today the Chief Data Officer’s job is to foster a culture that is the antithesis of this. This means brokering more data deals, spreading best practices, democratizing analytics, and supporting centers for analytics innovation – while providing necessary (and where possible automated) oversight.

Conclusion: It’s not a question of what data you want (or you think you’ll need), but what data you need now.

Collecting data and storing it may seem cheap, but as with everything there are substantial hidden costs. CDOs must help their company focus on the data that pays immediate dividends.

It’s clear that great CX and customer engagement are powered by these areas:

- Data – what data you collect and why

- Strategies – how, where, and when you intend to use the data in decision making

- Personas – the characters that will provide, use, and benefit from data

And data is really the foundation upon which it all rests.

But when it’s misused and abused, data turns into a liability, dragging down margins, clouding decision making, and adding risk. When used responsibly, it offers us a powerful way to scrutinize the past, understand the present, and forecast the future. It becomes an asset, providing returns for both the customer and the business. And the Chief Data Officer plays the leading role in how well this crucial asset contributes to improved CX and business performance.

Learn more:

- See how one large financial institution is using data and intelligence to increase customer loyalty and grow value.

- Discover how Pega Customer Decision Hub™ helps you visualize the customer journey and leverage your data to create personalized engagements.

- Watch this video to learn how to create a one-to-one, next-best-action customer engagement strategy.

- Attend PegaWorld iNspire to test-drive the latest AI-based software and get candid insights from some of the world’s biggest brands on one-to-one customer engagement success.