Chartis has named Pega a leader in Know Your Customer (KYC) Solutions. Pega received the highest possible score in three of the four categories in the Chartis KYC Solutions 2022 Market Update and Vendor Landscape.

The KYC landscape is heating up due to geopolitical issues, regulatory changes, and rising customer expectations. Now more than ever, financial institutions need an advanced KYC platform to drive better customer experience while managing customer risk.

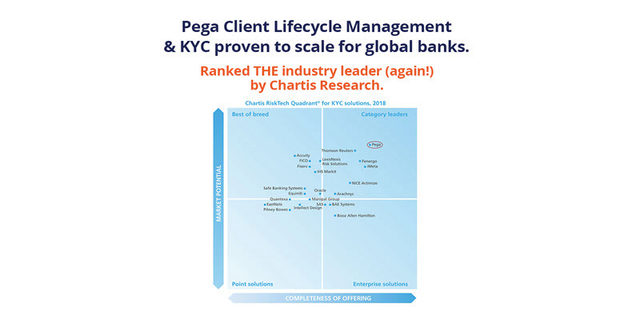

In the report, which includes its RiskTech Quadrant® for KYC Solutions, Chartis evaluated the 32 most significant KYC across four criteria. Pega received the highest possible score in three of these categories:

- providing best-in-class capabilities across KYC customer onboarding

- KYC risk scoring

- reporting and dashboarding

Chartis describes category leaders as combining “depth and breadth of functionality, technology, and content, with the required characteristics to capture significant share in their market.” It adds that leaders also “typically benefit from strong brand awareness, global reach, and strong alliance strategies with leading consulting firms and systems integrators.”

“Building on its historically strong market position, Pega has expanded its KYC functionality with perpetual KYC monitoring and low-code capabilities differentiators,” said Phil Mackenzie, research principal, Chartis. “The company has also expanded its corporate KYC capabilities to provide a more complete solution, and this – combined with its strong market presence – is reflected in its Category Leader position in Chartis’ 2022 KYC Solutions Quadrant.”

Pega delivers global KYC applications at scale

The world's largest financial institutions rely on Pega’s industry-leading low-code platform for AI-powered decisioning and workflow automation to accelerate their acquisition and onboarding of new clients. This includes managing highly regulated KYC and Client Lifecycle Management (CLM) processes. Pega streamlines compliance and onboarding processes, automates customer journeys, and reduces the costs of addressing KYC requirements. It is also the only vendor that provides globally scalable CLM and KYC applications with inherent workflow automation, an automated KYC rules engine, and advanced case management.

Clients choose Pega due to its ability to manage variations in KYC regulations and policies across different customer segments, products, and jurisdictions while leveraging advanced rules management capabilities that can be configured by the business to adapt instantly to constantly changing regulation. Pega’s solutions also provide the ability to seamlessly incorporate data from various internal, external, and third-party systems. Pega streamlines the customer and employee experiences while driving significant efficiencies such as reductions in onboarding times. This is all delivered in an event driven architecture to ensure financial institutions are assessing changing customer risks in a proactive manner.

We believe that Chartis recognizes the value that Pega brings to financial institutions that continuously want to improve their onboarding and ongoing due diligence processes while managing customer experience.