Unleash the impossible

Do more. At the speed of gen AI. Pega Infinity 24.1 makes AI your partner in innovation across your entire enterprise. Achieve speed, value, and impact that’s truly – yes – infinite.

Discover what Infinity 24.1 can do for you.

Explore the release

How are you looking to make an impact?

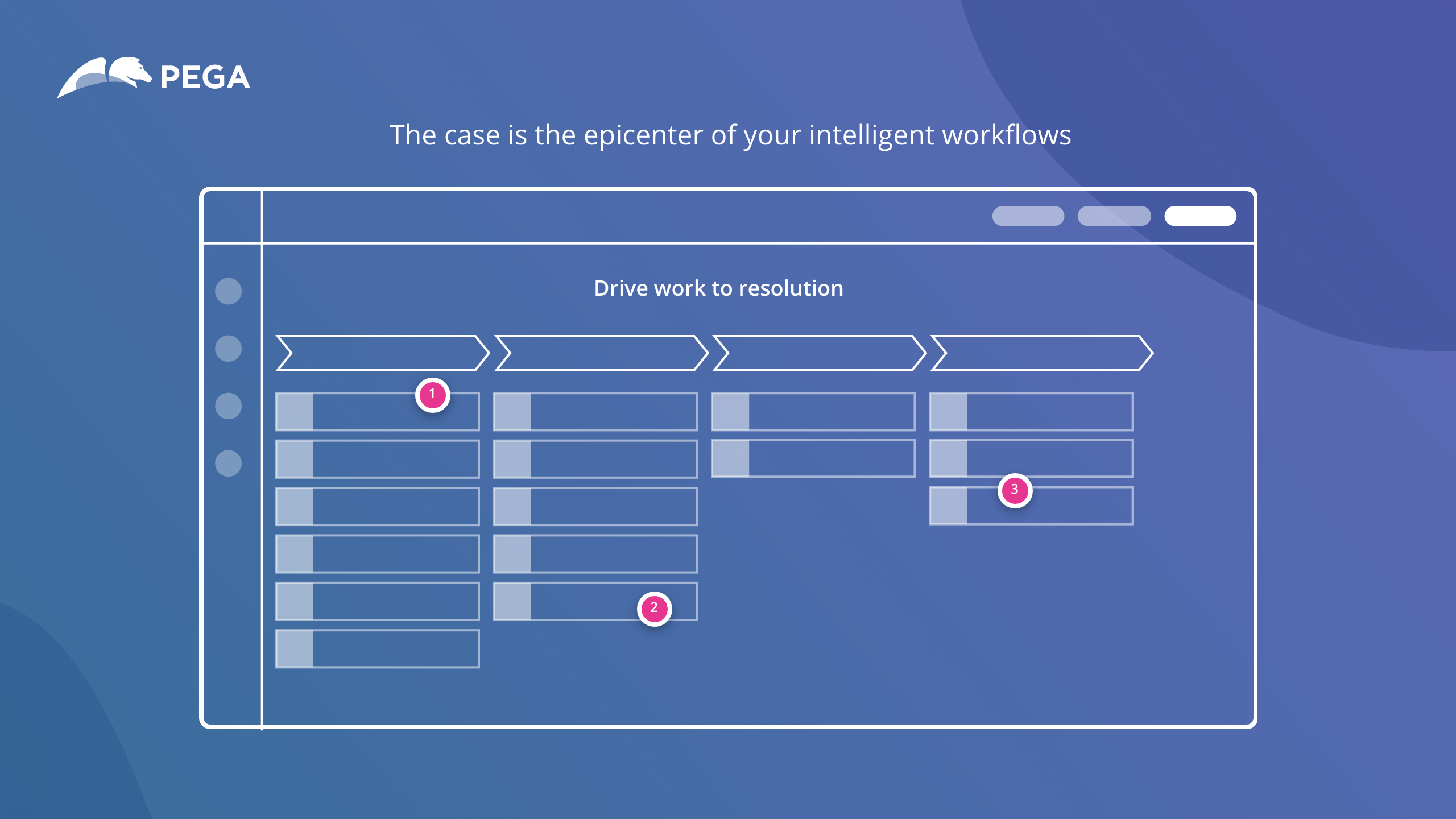

Pega is architected differently to run your most critical journeys.

How New Jersey Courts stayed in session during a global pandemic

NJ Courts was able to go fully virtual almost overnight and swiftly build for tomorrow with Pega Cloud.

"Because we were in the cloud, we were able to stand things up in about 48 hours that otherwise would have taken us months to do."

Recommended for you

Interactive Demo

Take the Pega Platform tour

Take the tour.

Interactive Demo

Build an enterprise-ready app in minutes

Test out Pega GenAI yourself.

Live Webinars

See what's new in AI with Pega Infinity '24.1

Learn how our most powerful release yet, Pega Infinity '24.1, can transform your enterprise.

40 years of software

innovation is only the beginning

innovation is only the beginning

Start your journey to an autonomous,

self-optimizing enterprise here.

self-optimizing enterprise here.