Pega Smart Investigate

Improve your exception processing efficiency with Pega.

"HSBC's GPI initiative has transformed the bank’s operations in a key area of client service by giving clients added confidence that any payment inquiry will be resolved quickly, efficiently, and with a single point of contact."

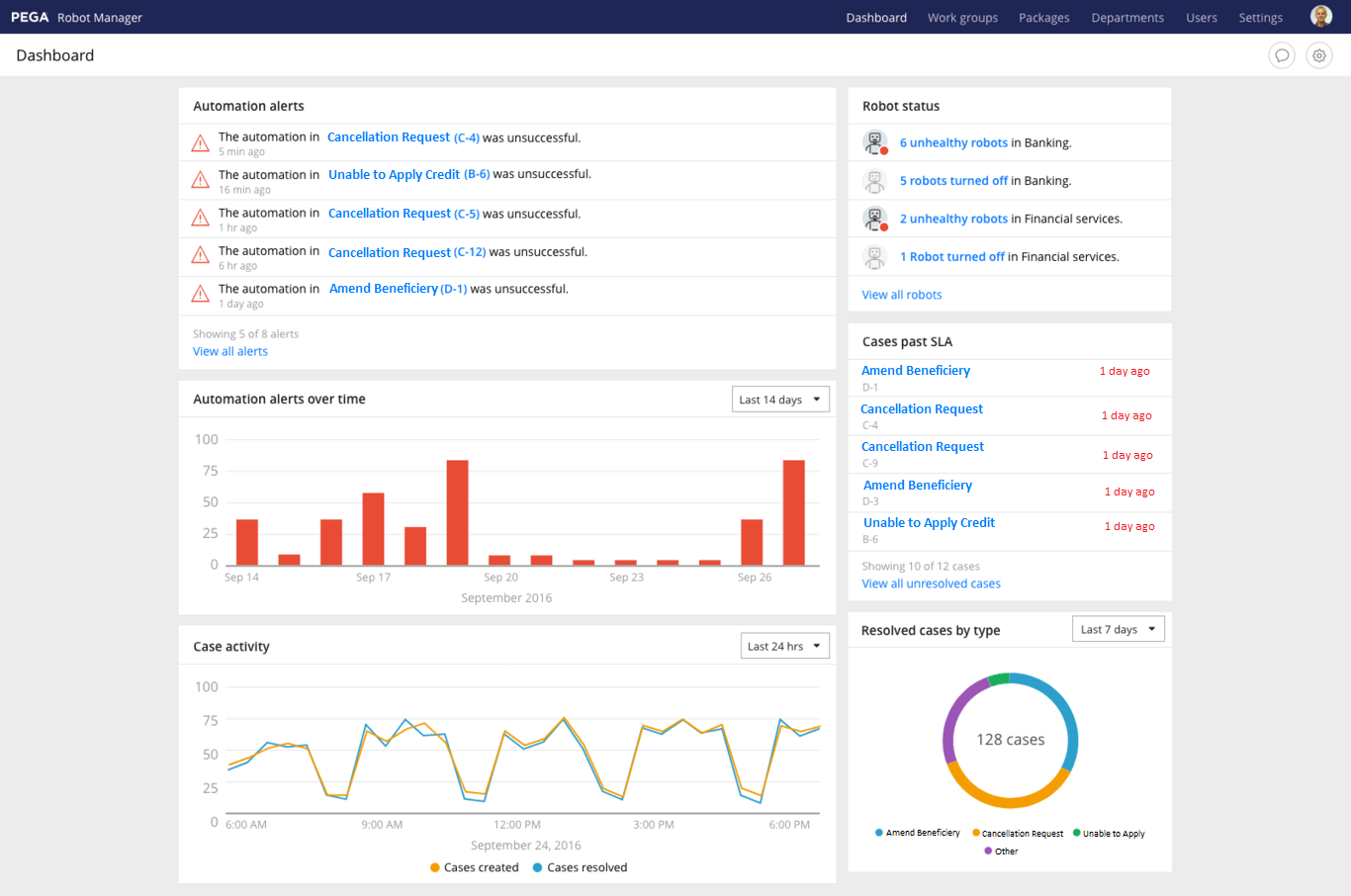

Automate your payments exception process

Experience total messaging and interoperability support

Leverage out-of-the-box support for new ISO messaging and resolution process standards while maintaining support for current MT formats.

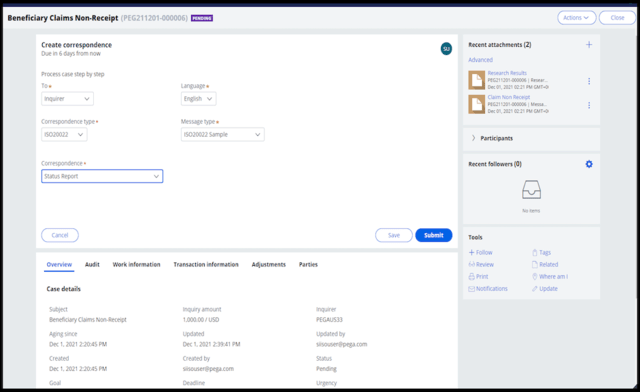

Automate case creation and straight-through processing

By automatically parsing SWIFT messages to generate new cases and retrieving existing payment data, Pega can help you achieve over 30-90% full automation of basic payment inquiries.

Increase productivity with end-to-end process management

By driving the distribution of work to the right person at the right time, Pega can help you create a seamless experience across multiple channels and systems through intelligent routing.